Tepat - realizing good intention faster

Realizing Good Intention Faster

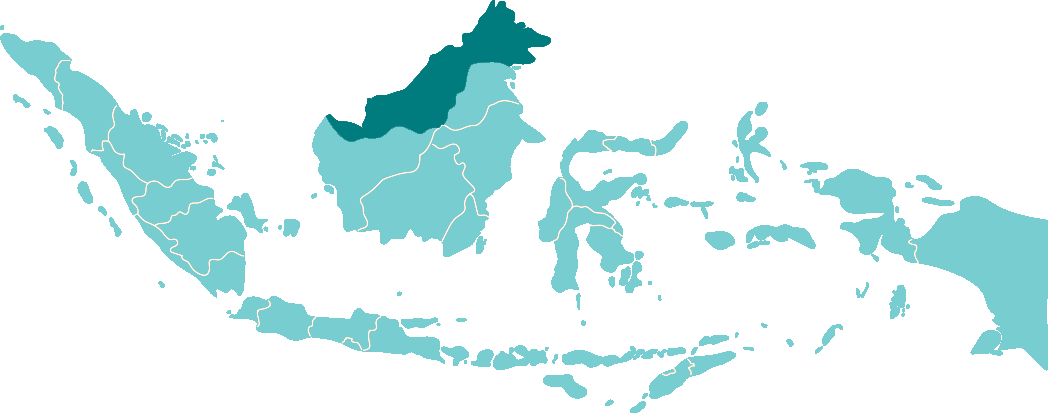

Since its establishment as Sharia Business Unit of PT Bank Tabungan Pensiunan Nasional Tbk (currently named “PT Bank BTPN Tbk”) in 2010,

BTPN Syariah has included and reached the segment that had not been touched by banking sector, that is the inclusive communities segment.

With the mandate to deliver empowerment activities and financial literacy for the women in the country,

BTPN Syariah provides access and banking products and services in Sharia principles for them to affirm the intention to realize the aspiration for a better life.

On 14 July 2014, BTPN Syariah was officially registered as the 12th Sharia Commercial Bank in Indonesia by the spin off

PT Bank Tabungan Pensiunan Nasional Tbk’s (currently named “PT BTPN Syariah Tbk”) Sharia Business Unit and the conversion of PT Bank Sahabat Purna Danarta (“BSPD”).

As the only Sharia Commercial Bank in Indonesia with the primary focus to provide services for empowering the inclusive communities customers and developing financial inclusion,

BTPN Syariah has always strived to provide added value and make a difference in the life of every customer being served, despite delivering good financial performance.

Hence, BTPN Syariah will always continue to develop and enhance the product and service delivery.

Therefore, BTPN Syariah will continue to bring positive impacts to millions of Indonesians as the real manifestation of the

aspiration to become the Mercy for the world (rahmatan lil alamin).

Funding

Funding customers are given plenty opportunities to contribute in the empowerment of millions of productive underprivileged customers in Indonesia in order to create a more meaningful life. #deminiatbaik (for good intention) in order to realize this good intention faster, the Bank provides various funding products with competitive returns with services that are oriented to customers satisfaction. This is proven by the performance of competent #bankirpemberdaya (bankers who empower), the good reputation of the bank, healthy financial performance and the Bank transparency in managing the funds.

Financing

Applying the Sharia Principles, the Bank provides various financing products and services and opens the access to financial services for productive underprivileged women customers to get working capital and training and empowerment #deminiatbaik in order to realize the dream faster. This is in line with the vision of the Bank to become the Best Sharia bank for financial inclusion, making a difference in the lives of millions of Indonesian people. Upholding this vision, the bank develops the financing products and services that best suit the needs of the particular segment.

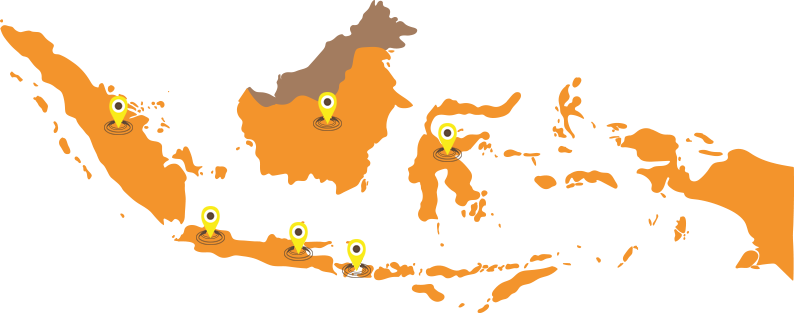

Branch Office Location

Our Journey

-

2008

BTPN established Sharia Business Unit -

2010

Piloting project Tunas Usaha Rakyat (TUR) that focused to serve the customers from the productive underprivileged segment, starting with 3 communities in Banten and Pandeglang area -

2011

Area expansion to serve the more productive underprivileged segment in Jakarta, Banten, West Java, Central Java, East Java, Sumatera and East Nusa Tenggara (NTT) -

2014

On 14 July, BTPN Syariah was officially registered as the 12th Sharia Commercial Bank in Indonesia

-

2018

On 8 May, BTPN Syariah was officiated as a public listed company by the code BTPS

-

2019

5 years as a Sharia Commercial Bank, 10 years of empowering the productive

poor segment, becoming the only bank focusing on serving

the underprivileged families in Indonesia -

2020

2 June, PT. Bank Tabungan Pensiunan Nasional Syariah Tbk. changed the name from PT. Tabungan Pensiunan Nasional Syariah Tbk. become PT. Bank BTPN Syariah Tbk. conform to the name of the Parent Entity.

7 July, PT. Bank BTPN Syariah Tbk. raising in rank from BUKU 2 Group Bank to BUKU 3 Group Bank organically.

18 November, PT. Fitch Ratings Indonesia raised its National Long-Term Rating from AA+ (idn) Stable Outlook to AAA (idn) Stable Outlook. -

2021

30 October, Referring to POJK Number 12/ POJK.03/2021 concerning Commercial Banks, a redefinition of Bank groupings has been carried out so that PT. Bank BTPN Syariah Tbk. become a Bank Group based on Core Capital 2 (KMBI 2).

23 October, Establishment of a Subsidiary named PT. BTPN Syariah Ventura

2 November, PT. Fitch Ratings Indonesia affirmed PT. Bank BTPN Syariah Tbk, National Long-Term Rating at AAA (idn), Stable Outlook.

-

2022

30 May, PT. BTPN Syariah Ventura as a subsidiary officially operates.

2 June, Updates to the Tepat Mobile Banking and Internet Banking e-channel services for funding customers.

30 September, PT. Fitch Ratings Indonesia affirmed PT. Bank BTPN Syariah Tbk, remains at AAA (idn), Stable Outlook.